Analysis of the results#

The analysis of the results from the topic modeling and subsequent refinements provides valuable insights into the themes related to uncertainty, particularly in the context of central bank policy.

Exploratory Data Analysis (EDA)#

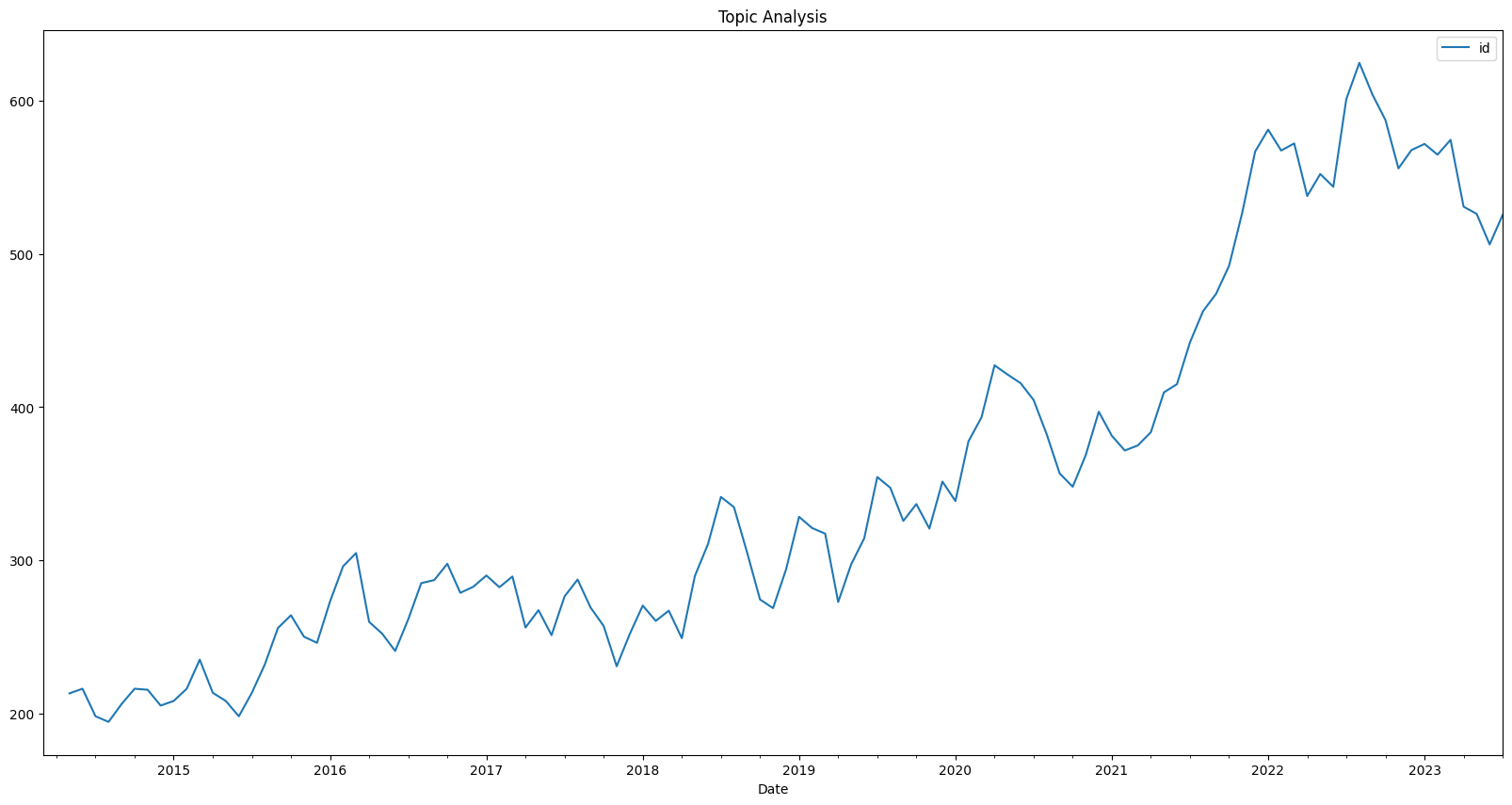

The Exploratory Data Analysis (EDA) provides an overview of the dataset used for the topic modeling, focusing on the number of articles and their average length over the years. Here’s a detailed analysis of the data:

Yearly Distribution#

The dataset spans from 2014 to 2023, with a total of 39,632 articles. The following observations can be made from the yearly distribution:

2014: The dataset begins with 2,047 articles, having an average length of 3,345 words.

2015-2018: A gradual increase in the number of articles is observed, reaching 3,530 in 2018, with average lengths ranging from 3,162 to 3,486 words.

2019-2020: The number of articles continues to grow, reaching 4,688 in 2020, with average lengths around 3,400 words.

2021-2022: A significant increase is noted, with 5,493 articles in 2021 and 6,866 in 2022, though the average length slightly decreases to around 3,100 words.

2023: The data for 2023 includes 3,750 articles, with an average length of 3,255 words.

Overall Trends#

Number of Articles: The dataset shows a consistent upward trend in the number of articles over the years, reflecting a growing interest in the subjects related to uncertainty, economics, and central bank policy.

Average Length: The average length of the articles remains relatively stable, with minor fluctuations. The overall average length across all years is 3,247 words.

| Year | num_articles | avg_length | |

|---|---|---|---|

| 0 | 2014 | 2047 | 3345.254030 |

| 1 | 2015 | 2804 | 3162.745720 |

| 2 | 2016 | 3345 | 3486.932436 |

| 3 | 2017 | 3183 | 3174.949419 |

| 4 | 2018 | 3530 | 3182.720963 |

| 5 | 2019 | 3926 | 3423.020122 |

| 6 | 2020 | 4688 | 3365.567193 |

| 7 | 2021 | 5493 | 3144.084653 |

| 8 | 2022 | 6866 | 3103.058549 |

| 9 | 2023 | 3750 | 3255.596800 |

| 0 | Total | 39632 | 3247.926751 |

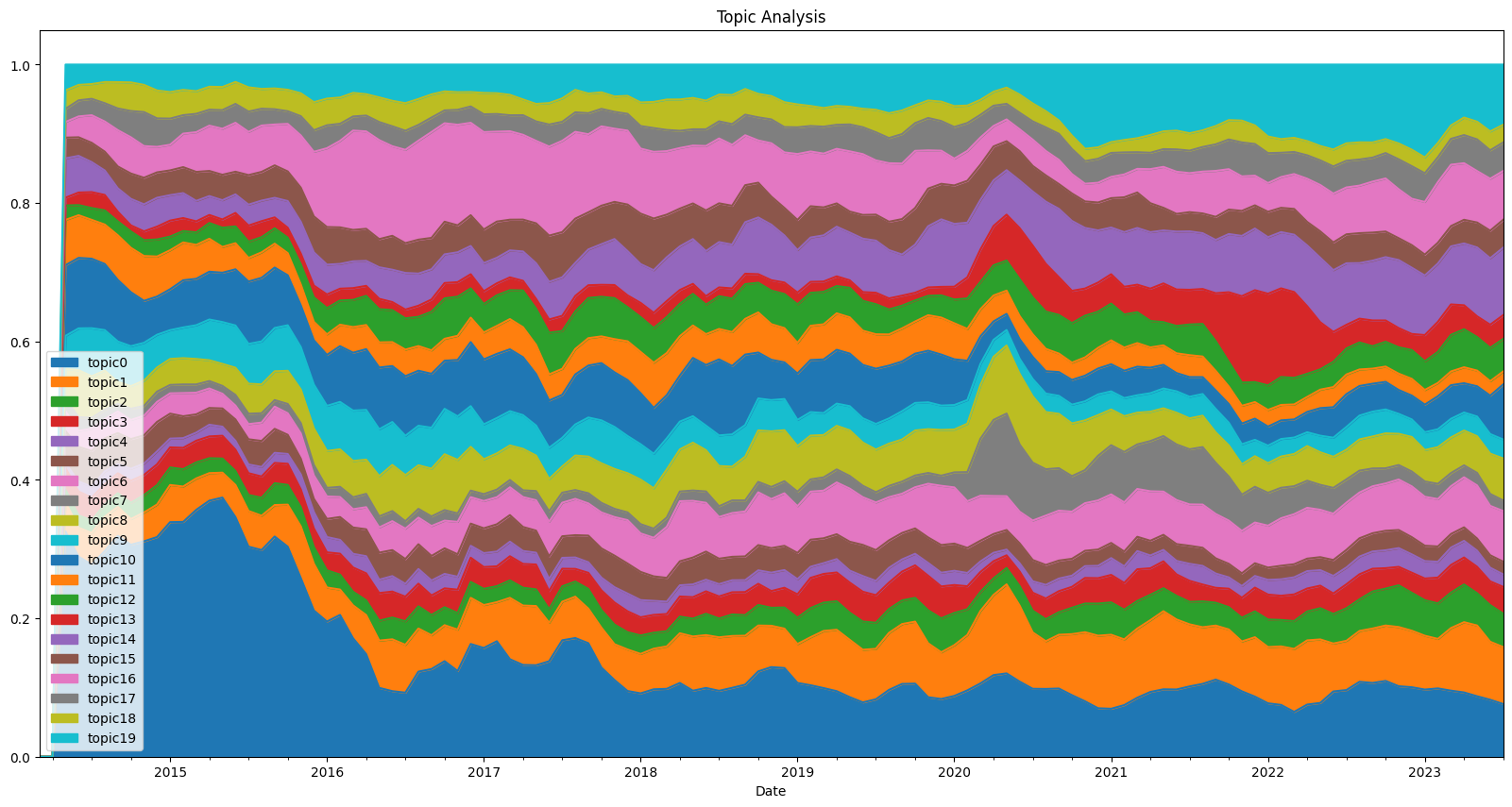

Topic Trend Analysis#

In the analysis of topic trends, we focus on three key areas: Economic, Banking, and ASEAN-related topics. The dataset spans from 2014 to 2023, and the topic weights represent the prominence of each topic within the corpus for each year. Here’s a detailed analysis of the trends:

Economic Topic: The declining trend in the Economic topic may reflect a shift in focus or changes in the global economic landscape. The consistent decrease might indicate a reduced emphasis on general economic indicators.

Banking Topic: The upward trend in the Banking topic, with a notable spike in 2020, suggests an increasing interest in banking and financial services, possibly driven by regulatory changes, technological advancements, or economic events.

ASEAN Topic: The fluctuation in the ASEAN topic, with a significant increase in 2020, may reflect regional developments, cooperation, or challenges within the ASEAN community.

| Economic | Banking | Asean | |

|---|---|---|---|

| timestamp | |||

| 2014-12-31 | 0.313100 | 0.044459 | 0.015407 |

| 2015-12-31 | 0.305647 | 0.051065 | 0.012842 |

| 2016-12-31 | 0.141942 | 0.058665 | 0.013761 |

| 2017-12-31 | 0.136633 | 0.065213 | 0.012843 |

| 2018-12-31 | 0.106295 | 0.066703 | 0.015911 |

| 2019-12-31 | 0.091526 | 0.077333 | 0.016898 |

| 2020-12-31 | 0.096598 | 0.100020 | 0.079986 |

| 2021-12-31 | 0.095097 | 0.090853 | 0.066534 |

| 2022-12-31 | 0.091314 | 0.080484 | 0.031264 |

| 2023-12-31 | 0.086958 | 0.088777 | 0.017232 |

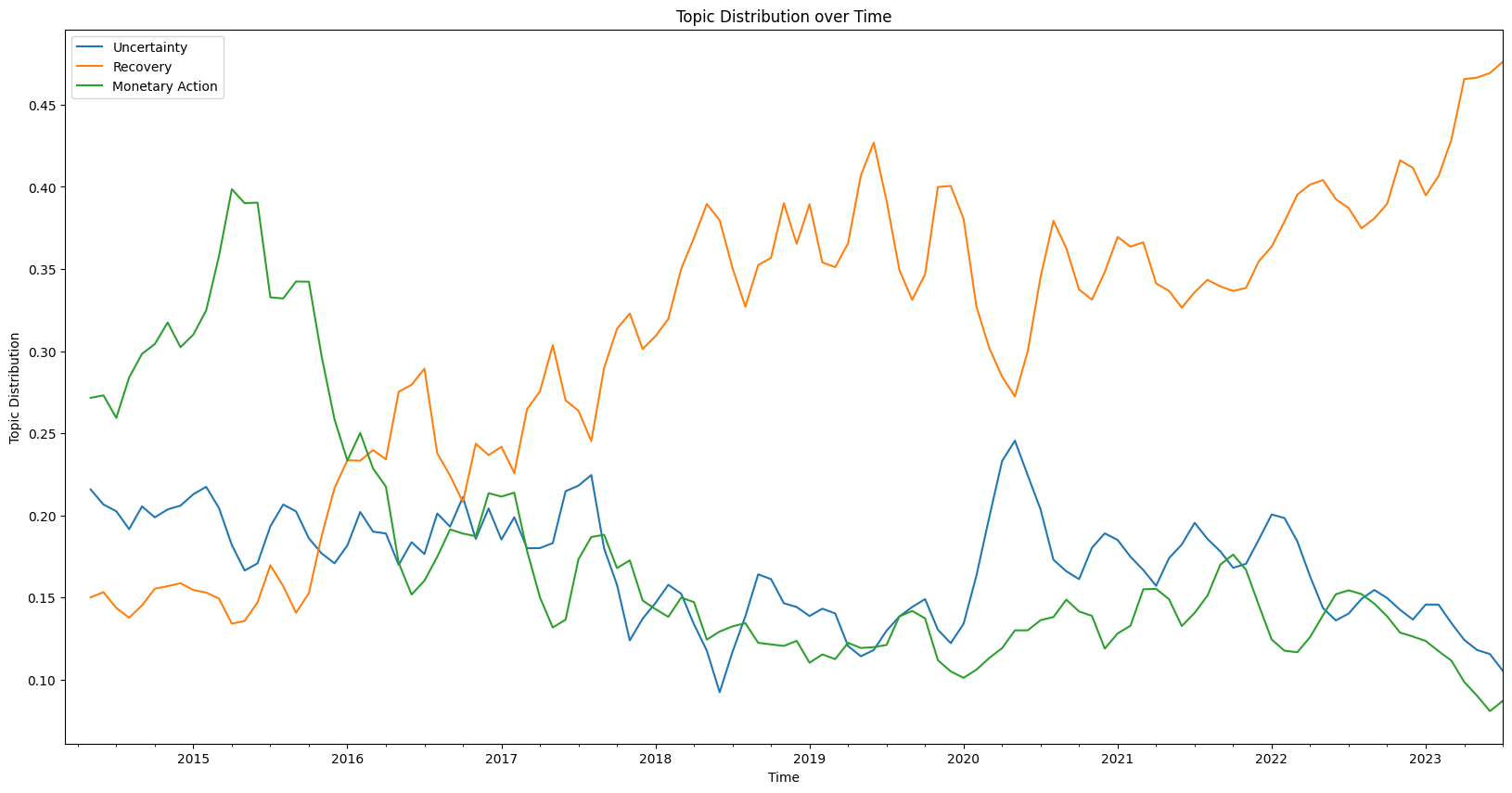

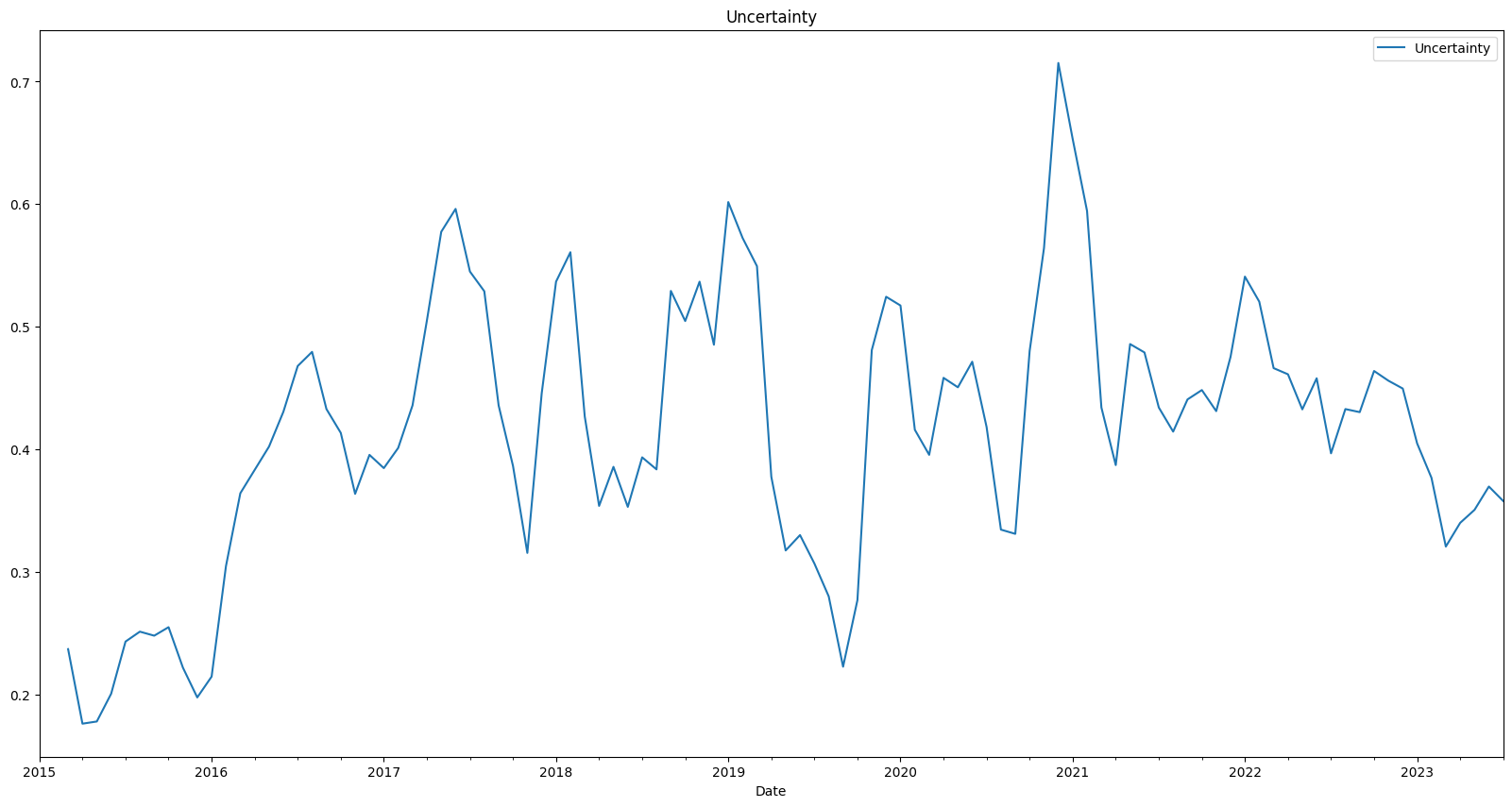

Uncertainty Analysis#

The uncertainty analysis focuses on the examination of economic activity, specifically targeting instances where the Economic topic weight is greater than 0.5. This threshold represents a significant concentration on economic themes within the documents, and the analysis aims to understand the trends and patterns related to uncertainty within this context.

Methodology#

Data Selection: The data is filtered to include only those documents where the Economic topic weight is greater than 0.5. This ensures a focus on documents that are highly relevant to economic activity.

Aggregation: The data is aggregated to provide a consolidated view of the uncertainty trends. The analysis considers data after January 1, 2015, to focus on recent trends.

Plotting: The uncertainty values are plotted over time, providing a visual representation of how uncertainty has evolved in the context of economic activity.

Analysis#

Trends: The plot of uncertainty reveals specific patterns and fluctuations that correspond to various economic events and conditions. Peaks in the uncertainty graph may align with significant economic events, policy changes, or market volatility.

Correlation with Economic Activity: By focusing on documents with a high Economic topic weight, the analysis provides insights into how uncertainty is manifested within the economic discourse. This can reveal how uncertainty is linked to specific economic indicators, policies, or sectors.

Temporal Dynamics: The time-series analysis allows for the examination of seasonal patterns, cyclical trends, or responses to one-off events. This temporal perspective can help in understanding the underlying drivers of uncertainty within the economic context.

The uncertainty analysis provides a nuanced view of how uncertainty is expressed and evolves within the realm of economic activity. By focusing on documents with a strong economic emphasis, the analysis captures the specific language, themes, and concerns that characterize uncertainty in this domain.

The insights derived from this analysis can be valuable for economists, policymakers, investors, and business leaders who need to understand the nature and implications of uncertainty in the economic landscape. It can inform risk assessment, decision-making, policy formulation, and strategic planning.

Further research could explore correlations with external economic indicators, conduct sentiment analysis to gauge the tone of the discourse, or apply machine learning techniques to predict future uncertainty trends based on historical patterns. By integrating these additional layers of analysis, a more comprehensive and actionable understanding of economic uncertainty can be achieved.

# save as csv

agg.to_csv("uncertainty.csv")

Article Retrieval for Uncertainty Analysis#

The article retrieval process is a vital step in conducting a nuanced and context-specific analysis of uncertainty. By carefully selecting the topic, date range, and number of articles, the analysis ensures that the most relevant and insightful materials are gathered for further examination.

This approach can be adapted and extended for various research objectives, such as tracking the discourse on other topics, conducting longitudinal studies, or integrating with other quantitative measures. It serves as a bridge between quantitative topic modeling and qualitative content analysis, leveraging the strengths of both methodologies to provide a comprehensive understanding of the subject matter.

articles = ta.find_articles(

topic="Uncertainty", start_date="2020-10-01", end_date="2020-12-31", n=20

)

print(articles.text.values)

['As Prime Minister Hun Sen is set to announce the Kingdom’s plans on obtaining a COVID-19 vaccine today, the Ministry of Health yesterday declined to provide any details on possible sourcing.\nIn a late phone call to Khmer Times, Ministry spokeswoman Or Vandine said she would wait for the Prime Minister to outline details.\nMr Hun Sen will hold a special live broadcast to inform the public about the COVID-19 situation and the purchase of a vaccine at about 9am via national television.\nHis address will come after he ordered officials from the ministries of Health and Finance to discuss the sourcing and funding of a vaccine last Monday.\nSpeaking to the press yesterday, Head of the Press and Quick Reaction Unit at the Council of Ministers Svay Sitha said that the live broadcast will be conducted from the Prime Minister’s residence in Kandal province’s Takhmao City.\nHe said that Mr Hun Sen will raise the issue of COVID-19, especially the “November 28 community incident”.\nSeveral types of vaccines have been or are being developed and some, like the Pfizer-BioNTech Covid-19 vaccine and China’s Sinovac have already been distributed for use in several countries including in Asean.\nThe countries which received doses had previously pre-ordered them.\nOn December 7, Mr Hun Sen announced plans to purchase the COVID-19 vaccine for free distribution to Cambodians. He plans to buy about one million doses in the first phase to give to about 500,000 people.\nMeanwhile, some people completing their mandatory 14-day quarantine at Phnom Penh hotel have complained they were asked to pay an extra $65 for their stay before finally being allowed to check out\xa0late evening due after an official clearance letter from the Health Ministry that they were free from COVID-19.\nA foreigner who ended her quarantine at the hotel on Saturday said that the hotel issued her the bill for the quarantine period and informed that she would be checking out once the MoH issued the COVID-19 results.\nShe said in the evening the receptionist informed her that the COVID-19 results came back negative and that they were waiting for the ministry to send the release order via email.\n“Around 8pm, the receptionist called again to state that I have to pay an extra $65 as that was the hotel policy.However, I argued with her stating that we had already deposited $2,000 with the Ministry of Health and thus the due payments will be deducted accordingly and the balance to be returned,” she said.\n“The receptionist then said that the $65 will not be deducted from the deposit but I had to pay separately as that was hotel policy,” she added.\nThe foreigner said that another couple when met at the waiting area to check out said they too received the call asking for the $65.\nHowever, she added that when she went to the reception area to collect her passport and other documents, she was not asked for the money.\n“The hotel management and staff took good care of us. Their services were good. \xa0The only twist to all the good deed was the bill which came as a surprise and shock,” she added.\nAn executive\xa0 of Phnom Penh Hotel, who asked to remain anonymous, told Khmer Times yesterday that under the quarantine policy of the Ministry of Health, the hotel will only allow guests to leave the hotel if their COVID-19 test results are negative and the hotel’s universal policy is free of charge if the guests leave before check-out time of 12 noon.\nA housekeeping manager of Tianyi Hotel Ly Anny said yesterday that her hotel does not charge extra for quarantined guests, except if they order extra food or items from the hotel. However, quarantine guests who have stayed at Tian Yi Hotel refuted this claim and said they were made to pay at least half a day for late check out.\n“If the customers want to buy something more from our hotel, we will sell according to the price list that we provide to the customers, and when the customers receive the goods, they have to give the cash at that time,” she said.\nAnny added that problems arose when guests wanted to leave the hotel immediately after completing their 14-day quarantine. However, the hotel could not allow them to do so without the ministry clearance which was usually issued late.\nShe urged the Ministry of Health to expedite the release of the results and not cause any delay.\nThe director of the ministry’s Communicable Disease Control Department Dr Ly Sovann could not be reached for comment yesterday.\nIn another development, the Kingdom reported no new positive cases of COVID-19 yesterday, and there were two recoveries.\nIt has been three consecutive days that no new COVID-19 cases have been found linked to the “November 28 community incident”, according to the Health Ministry.\nThe two recoveries include a Cambodian woman, 35, from Kampot province’s Toek Chhou district and a Cambodian American man, 49, from Phnom Penh’s Por Senchey district.\nThe woman arrived in Cambodia from China on November 18 and she tested negative for the virus twice while the man arrived in the country from the United States via Taiwan on December 4.\nThey were discharged from the hospitals yesterday.\nThe ministry also said that it has tested more than 3,400 of 6,700 samples from Saturday and Sunday linked to the “November 28 community incident” and the results came back negative for the virus.\nThe remaining 3,324 samples are scheduled to be tested today, it said.\nTo date, Cambodia has recorded a total of 359 people with COVID-19 (84 females and 275 males). The total number of recoveries is 309, with 50 being hospitalised.\nIn related news, the National Assembly yesterday announced that lawmakers and officials who tested negative for COVID-19 for the third time can now return to work.\nThe announcement was made after over 100 lawmakers and National Assembly officials, including its president Heng Samrin, were cleared of COVID-19 in their third round of testing on Sunday. All of them were asked to go in quarantine after they had a meeting with Loy Sophat, a lawmaker who came in direct contact with General Chhem Savuth, director-general of the Interior Ministry’s General Department of Prisons, who was one of the first victims of the “November 28 Community incident”.\n“Those who have tested negative for the third time can return to work as usual since the fourth testing is not required,” said NA Secretary-General Leng Peng Long.\nHowever, he added the lawmakers and officials who return to work today will have to follow the preventive measures imposed by the Ministry of Health to prevent COVID-19 infection in the future, including wearing face masks, washing their hands frequently, avoiding gathering and practising social distancing.\nAdditional reporting by Taing Rinith\n\xa0'

'Political intrigue can result in foreign net selling, meaning capital flows out from the country which can be inimical for the economy as a whole — with possible knock-on effects on the other variables such as employment levels, currency value, exchange rate and bond yields.\nWhen the political leadership — which includes both leadership in the ruling and opposition coalitions — is distracted by the games of thrones and power play, this undermines economic stability.\nA clear example of political intrigue is when a politician makes an unexpected statement about having the majority number to form a government without due respect to the legal process as enshrined in the Federal Constitution, or creates a political drama leading to the dissolution of Parliament with its concomitant snap election being called.\nWhen these political machinations occurred amid a backdrop of a surge in the Covid-19 daily infection figures, this will cause the economic situation to degenerate even worse. As a result, the relationship between political intrigue and capital outflow is part of a country’s political economy.\nBased on a survey by the Merdeka Centre on 1,167 respondents aged 21 and above, 32.7 per cent thinks there is political instability in our country, while a measly 1.2 per cent thinks there is political stability in general. Thus, it can be seen that our country’s politics is not stable.\nThe Sheraton Move and Anwar’s shocked bombshell show political intrigues will lead to financial volatility via fluctuation in the stock and bond market which more often than not, leads to net capital outflow.\nAll the indices of Bursa Malaysia were in negative territory when the bourse closed on that fateful day, with Bursa Malaysia Construction Index hit worst — falling from 12.6 points to 194.81 or by 6.07 per cent.\nThe benchmark FBM KLCI index fell below 1,500 points, skidding to an intraday low of 1,486.71 points, its lowest level since December 2011, closing at 1,490.06 — down by 2.69 per cent or 41.14 points.\nLet’s now see the dynamics of the stock exchange on September 23 when Opposition Leader, Datuk Seri Anwar Ibrahim claimed that he had a formidable and strong majority to form a new government — another political intrigue in our country.\nMinutes after Anwar’s announcement, amid an already weak market sentiment, the FBM KLCI fell by 0.9 per cent to 1,494.18, as of 12.22pm. Like a domino effect, it later fell by 17.24 points to 1,491.74 at 2.32pm.\nBut a few hours later, Prime Minister Tan Sri Muhyiddin Yassin gave the stock market some boost by announcing a new RM10 billion stimulus package. As a result, FBM KLCI ended down by 9.30 points, or 0.62 per cent, at 1,496.48, down from the previous day’s close of 1505.78.\nIn short, the FBM KLCI opened on the day of Anwar’s announcement by a slight increase of 1.51 points at 1,507.29, but fluctuated between 1,491.17 and 1,509.15 throughout the day after Anwar’s announcement before ending at 1,496.48. RM12.01 billion was wiped out from the bourse.\nWith the current spike in the number of Covid-19 infections, political intrigue will definitely lead to capital outflow, which in turn will result in slower economic growth, reduced employment rate, uncertainty in the bond market and a weaker currency.\nAccording to some equity strategists and fund managers, political uncertainty has intensified since the split in Pakatan Harapan, with the Covid-19 pandemic casting a shadow over the outlook for global economic growth, further dampening already weak market sentiment.\nOn September 30, international ratings agency, Fitch Solutions, predicts politics in Malaysia is expected to blunt economic growth for the next decade. Combined with slower population growth and reduced fiscal space to cushion against negative future economic shocks, Fitch predicts real GDP growth to be at just 3.4 per cent over the next 10 years compared to 6.4 per cent over the past decade.\nTherefore, it is clear that there is a direct relationship between political intrigue and capital outflow, which will lead to financial volatility and a negative impact on the economy in terms of people’s livelihoods and investors’ confidence.\nA frequent change of government within a short period of time means government policies will be in a flux, with companies especially foreign investors like the MNCs unable to plan and make reasonable forecasts on their project, leading to their wait-and-see stance when it comes to their investment commitments in Malaysia.\nHenceforth, we should resolve political uncertainty through a scheduled general election rather than political wrangling. By doing so, there is economic stability which will impact on the good performance of our country’s economy.\nIn light of the unprecedented situation in our country, there shouldn’t be any political intrigue or drama that either culminates in a power grab or a snap call election being called until Malaysia is declared Covid-19 free and the economy is on a firm footing or the 15th General Election is called as schedule in 2023, whichever comes first.\n\xa0\nJamari Mohtar and Tam Mei Si are with the research team of think-tank EMIR Research. This is the personal opinion of the writers or organisation and does not necessarily represent the views of Malay Mail.\n\xa0'

'The market appears undecided whether the recent fall in the share price of industrial park operator Phnom Penh Special Economic Zone (CSX: PPSP) now offers a good investment opportunity. The board is currently awaiting approval for the share buyback plan submitted to the regulator last week. PPSP shareholders approved the buyback strategy in replacement of a dividend payment in late October.\nLiquidity in the stock has soared since its price reached its record low of 1,310 riels a share at the close of trade last Friday. PPSP share transactions registered a record high on Wednesday with more than 290 million riels and 217,740 shares exchanged. Monday through Wednesday this week, trading reached a combined total of 589 million riels with 439,090 shares exchanged.\nHowever, despite the recent high liquidity, the stock price has held relatively steady, in trading above the 1,300 riels/share mark.\xa0 The current price represents more than a 50 percent drop from the initial public offering (IPO) of 2,890 riels per share in 2016.\nAt a fundamental level the stock has the highest price-to-earnings ratio (P/E) of any listed company on the exchange at\xa0 a little over 53 compared with the lowest P/E ratio on the exchange of around 5.5 held by Phnom Penh Autonomous Port (CSX: PPAP).\nThe P/E ratio is a measure of earnings per share over a company’s last four quarterly reports and is traditionally used for valuing stocks to determine whether they are over-priced or underpriced.\nA local investor, who spoke to Khmer Times recently said he had done well from investing on the exchange and is now considering a buy-and-hold strategy with PPSP.\n“I was involved in some of the major stock IPOs such as ABC, PWSA and PEPC [and] have been able to profit overall… I am now considering the idea of a buy-and-hold approach for PPSP stock,” the investor said.\nTwo weeks ago PPSP Chief Financial Officer Fong Nee Wai said in his opinion the company share price (which was trading at 1,490 riels a share at the time) was extremely undervalued and that he believed there were buyers in the market who saw potential value and (would) be prepared to invest and buy shares from sellers.\nFong added that because of the price pressure exerted by sellers, who had possibly had a change in rationale for holding PPSP shares, the share price has drifted lower, a factor beyond the company’s control.\nHe also noted this was not specifically lmited to the PPSP share price and that most of the shares listed on the Cambodia Securities Exchange (CSX) were also lower, as indicated by the declining CSX index over the past months.\nPPSP’s 2020 third-quarter report filed to the CSX showed that its total revenue of $2,538,182 was up 19.53 percent against 2019 third-quarter numbers and the company’s after-tax profit of $270,164 was up 134.86 percent year-on-year.\n\xa0\nHowever, this quarter-to-quarter comparison could be considered misleading when expanded to compare with the first nine months of 2020. PPSP only made $537,246 during that period, down 93 percent compared with $8,615,848 over the same timeframe last year.\nAccording to PPSP Chairman Tan Kak Khun: “The financial position of the company remains strong” with total assets of $95,142,366 and total equity amounting to $59,944,787, representing a debt-to-equity ratio of 0.59.\nIn addition, to its declining profits and stock price, it was disclosed to the exchange in late November that the company was in arbitration with a Singapore Exchange-listed company. It was revealed that Asiatic Group (Holdings) Ltd (AGHL), the Singapore listed company, had started arbitration proceedings against the PPSP, seeking a minimum of $14.4 million (representing 24 percent of the company’s total equity) in relief over a disputed power supply contract.\nKhmer Times has been in contact with Asiatic management since the arbitration case was announced and was told this week: “So far, we are waiting to set a date for the arbitration and will provide further updates as they come.”\nPPSP has responded to the claims, stating in a disclosure letter that PPSP denies AGH’s allegations in their entirety and will take all necessary steps to vigorously defend itself against these “baseless” claims.\nPPSP is presently considering its options and will keep shareholders informed on its next steps over the coming weeks, consistent with its obligations of confidentiality in relation to the arbitration.\nAs of market close yesterday, PPSP was trading at 1,330 riels per share.'

'AFP – The European Central Bank (ECB) likely saved the eurozone from several financial crises but it is also accused of exacerbating inequality with its ultra-loose monetary policies.\nUnder the direction of Mario Draghi and now Christine Lagarde, the ECB has purchased billions of euros worth of sovereign and corporate debt since 2015 to keep borrowing rates down in the eurozone and ward off additional crises.\nThe unconventional policy is known as Quantitative Easing (QE) and it has been implemented along with more classic methods of boosting the economy, such as ultra-low interest rates that currently hover around zero.\nThe bank might unveil additional, or stronger, measures this week.\n“Asset purchases tend to mechanically widen the gap between the most wealthy and the least wealthy,” notes Jezabel Couppey-Soubeyran, professor of monetary policy at the Paris-1 University.\nWhen it buys debt from financial institutions on secondary markets, i.e. after the debt has already been issued, the ECB and other central banks effectively lower the rate of interest that countries and companies must offer to obtain funds.\nInvestors often then turn to assets that involve more risk but which offer better returns, such as stocks, causing share prices to rise.\nThat generally benefits shareholders such as investment groups and wealthy individuals.\nInterest rates have fallen sharply since QE began, and are sometimes negative now for counties such as France and Germany, while the CAC 40 and DAX stock market indices have surged by more than 30 percent in the past five years.\nShareholders have obviously benefited as a result.\n“It is certain, that [QE] has enriched this class of the population,” confirmed Frederik Ducrozet, a strategist at Pictet Wealth Management.\nLow interest rates have also allowed wealthy households to benefit from higher real-estate values because demand has driven up prices in many metropolitan areas.\nECB chief economist Philip Lane acknowledged as much in a recent interview with the French financial daily Les Echos, by saying that the bank’s monetary policy had “immediate consequences for asset prices”.\nHe added that “the value of shares and property is higher which, of course, benefits those who own these assets.”\nThe ECB, which is based in Frankfurt, declined to comment on this question.\nBut in January 2019, two central bank staff said in a study that QE had helped reduce unemployment among the bottom 20 percent of wage earners in four countries – France, Germany, Italy and Spain – and raised their wages.\nUltra-low interest rates have also allowed less-wealthy households to buy property, thus reducing inequality, they maintained.\nThat said, several ECB papers have concluded that such reductions have not been particularly significant.\nAnd Couppey-Soubeyran pointed out that comparable statistics on unemployment between the eurozone and broader European Union do not demonstrate a large difference that could be attributed to ECB policies.\nThe central bank acknowledges a negative impact on thrifty households that have seen the value of their savings decline owing to low interest rates.\nThe bank’s policy has had a “distributive” effect and affected households that are net borrowers and those that are net savers in a “heterogeneous manner”, according to Eric Dor, research director at the IESEG School of Management.\nECB economists have argued that such negative effects were offset by support for employment and wages.\nAnd Dor agreed that strong central bank support for wages, in particular those of poorer workers, “has more than compensated for the fact that some households have suffered an overall loss owing to net interest revenues.”'

'LONDON (AFP) – Millions of people in England and Italy will celebrate Christmas under tough new coronavirus restrictions as Europe battles a winter surge including a more infectious new strain.\nEurope has become the first region in the world to pass 500,000 deaths from COVID-19 since the pandemic broke out a year ago, killing more than 1.6 million worldwide and pitching the global economy into turmoil.\nIn England, where a lockdown-weary population had been looking forward to a temporary five-day relaxation of virus restrictions over the festive period, British Prime Minister Boris Johnson instead announced a new “stay at home” order for London and southeast England – an area including around a third of the country’s population.\nThe move follows alarm at the speed at which the virus was spreading and a new strain that Johnson said was “up to 70 percent more transmissible”.\n“It is with a very heavy heart I must tell you we cannot continue with Christmas as planned,” he told the nation in a televised briefing on Saturday.\n“Alas when the facts change, you have to change your approach,” he said.\nResidents in the affected areas will have to go into lockdown at least until December 30, Johnson said, tearing up earlier plans that would have allowed up to three households to mix.\nHours later the Netherlands banned all passenger flights from Britain after finding the first case of the new, more infectious virus strain that is circulating in the UK.\nThe ban is in effect until January 1.\nThe Netherlands is under a five-week lockdown until mid-January with schools and all non-essential shops closed to slow a surge in the virus.\nItaly also announced a new regime of restrictions until January 6 that included limits on people leaving their homes more than once a day, closing non-essential shops, bars and restaurants and curbs on regional travel.\n“It’s right that they prohibit departures after December 20 if it means travelling in safety,” Claudia Patrone, a 33-year-old lawyer, told AFP as she got off a train in Milan. “I took the test before leaving, I stayed locked in my house, I didn’t see anyone. The measure is right if everyone respects the rules and guarantees safety.”\nEurope – the epicentre of the pandemic earlier this year – is once again seeing growing cases with officials fearing an explosion in infections after the Christmas holidays as families gather.\nA year after the pandemic first emerged in the Chinese city of Wuhan, the rapid rollout of vaccinations is now seen as the only effective way to end the crisis and the economically devastating lockdowns used to halt its spread.\nEurope is expected to start a massive vaccination campaign after Christmas following the United States and Britain, which have begun giving jabs with an approved Pfizer-BioNTech shot, one of several leading candidates.\nRussia and China have also started giving out jabs with their own domestically produced vaccines.\nThe United States on Friday authorised Moderna’s COVID-19 vaccine for emergency use, paving the way for millions of doses of a second jab to be shipped across the hardest-hit country in the world.\nIt is the first nation to authorise the two-dose regimen from Moderna, now the second vaccine to be deployed in a Western country after the one developed by Pfizer and BioNTech.\nMillions of doses will start shipping out as early as this weekend from cold-storage sites outside Memphis and Louisville. More than 272,000 people have already been vaccinated with the Pfizer jab, the US Centers for Disease Control and Prevention said.\nWith the country now registering more than 2,500 deaths a day from COVID-19, senior officials including Vice President Mike Pence stepped up to receive early vaccinations on Friday.\nPence’s public inoculation was the most high-profile attempt yet at persuading vaccine-sceptic Americans to join a national effort to halt a pandemic that has infected more than 74 million worldwide.\nPresident-elect Joe Biden, who will take office on January 20, announced he would get the vaccine, also in public, today.\nIn Europe, Slovakian Prime Minister Igor Matovic became the latest high-profile figure to test positive for COVID-19 a week after attending a European Union summit in Brussels.\nThe summit is believed to be where French President Emmanuel Macron also caught the virus. Macron’s diagnosis on Thursday led to a slew of European leaders and French officials rushing into self-isolation.\nIn Australia, a cluster of cases on Sydney’s northern beaches grew to 38, with residents ordered to stay home from late Saturday other than for essential reasons.\nNew South Wales state Premier Gladys Berejiklian pleaded with Sydney’s more than five million residents to remain in their homes.\n“We’re hoping that will give us sufficient time to get on top of the virus so that we can then ease up for Christmas and the New Year,” she said.\nIn India the total number of cases climbed past 10 million on Saturday, the second highest in the world, although new infection rates appear to have fallen sharply in recent weeks.\nIsrael, meanwhile, set new coronavirus rules including a requirement for residents returning to the country from Sunday to self-isolate.'

'Flooding has created uncertainty over the Kingdom’s economic outlook this year, with various figures bandied about and thousands of households and paddies affected.\nHowever, economists are optimistic that even though the country has been hit by flash flooding, adding to the COVID-19 pandemic and also the partial loss of the everything but Arms (EBA) trade deal with the European Union, there will not be much change in reality.\nBefore the floods, the government and international financial institutions had different projections over gross domestic product (GDP).\nThe government maintains economic growth will contract 1.9 percent while global financial institutions have changed views because Cambodia has been less affected by COVID-19 than other countries in the region and, indeed, the world.\nThe World Bank predicted a contraction of negative 2 percent for this year. ADB has revised its 2020 growth forecast to a 4 percent contraction from its previous prediction of 5.4 percent in June while the International Monetary Fund projects that the Kingdom’s economy is forecast to shrink 2.8 percent this year.\nSunniya Durrani-Jamal, Asian Development Bank (ADB) country director for Cambodia, said it is too early to estimate the total economic impact from the flooding.\nHowever, she said the ADB will issue an economic update in December 2020 and the impact of the flooding will be reflected in this.\n“At this stage, the greatest concern is for the safety of the 70,000 affected households and ensuring they are sheltered,” she said. “We also want to stand with the other families that have been affected in Phnom Penh and Cambodia’s 18 other provinces [affected by flooding].”\nSunniya said that the government is doing its best to mitigate possible dire effects by prioritising the safety of those affected.\n“I believe a damage assessment will be prepared by the government with support from development partners as requested. After that, the ADB can help to prepare cost estimates for rebuilding if needed. The ADB has also offered to reallocate resources from its existing projects to emergency repairs of flood damage,” she said.\nVan David, a senior associate at public-private partnership PLATFORM IMPACT, said the ADB forecast was prepared before the floods and did not consider the heavy toll of damage incurred by heavy rain resulting in several hundred million dollars of losses.\nHowever, he said that the actual growth for all of 2020 remains unsure for now until a new assessment can be made.\n“Current flooding certainly caused a lot of collateral damage to the local economy but how much it may affect in percentage terms the actual full 2020 growth remains unclear until adequate assessments have been carried out,” he said.\nHong Vannak, a business researcher at the Royal Academy of Cambodia, reiterated Cambodia is now facing three challenges: the 20 percent loss of the EBA deal, COVID-19 and flooding.\nHowever, he said the issue of flooding will not change the economic outlook much. “The prediction of economic growth is reflected by trade activities, exports and imports and investment inflows but the real damage has been caused by the\xa0 COVID-19 pandemic,” he said, adding that with the government’s timely measures to contain it, the outlook has been more positive.\nMinistry of Economy and Finance spokesman Meas Soksensan said the government will adjust its projection at the end of the year.\nHe said the floods added another burden for the government to address urgently. However, the government has yet to make any assumptions on their impact.\n“The government has annually reserved a budget package which is allocated for relief from natural disasters such as floods,” he said.\nThe frequent deluges had affected nearly 70,000 families made up of 245,428 people as of Monday. A report by the National Committee for Disaster Management shows the floods affected 213,289 hectares of paddy, of which 32,382 hectares have been damaged.'

'The future of the COVID-19 pandemic, one of the worst socio-economic crisis the world has ever faced, remains uncertain, despite some positive news on the vaccine progress. In Cambodia, the garment industry has been hit hard by the crisis, causing many factories to shut down and tens of thousands of workers to become unemployed. In an exclusive interview with Khmer Times, National Trade Union Confederation president Far Saly says the workers in this sector are struggling while the unions are seeing their power to help them fade.\nKT: What has life been like for workers in the garment industry over the past few months?\nSaly: We can see that the overall situation has improved a little bit, but at the same time we have also seen a decrease in the workers’ bargaining power. Their benefits and working conditions have deteriorated while the employers keep using COVID-19 as an excuse to prevent the workers from asking for better working conditions and salaries. However, many workers have already been laid off. According to the Garment Manufacturing Association in Cambodia (GMAC), by July about 400 garments, footwear and travel goods factories in Cambodia had suspended their operations, leaving over 150,000 workers jobless due to the pandemic. These numbers should be higher now. We are also worried about the loss of EBA, which could lead to the loss of a lot of money in the industry.\n\xa0\nKT: What are the current challenges faced by the unions?\nSaly: We are losing our power to demand higher base salaries for workers. For 2021, we did our best, but we only managed to raise the minimum wage by $2 for the country’s garment and footwear industry. But, we do have a reason for that. With a plummet in overseas orders, factories are facing financial problems, and we definitely cannot force money out of them. However, if the situation gets better in 2021, we will demand higher wages for our workers. Even now, we can see that some factories offer higher than the $192-per-month minimum wage, which at least provides us with hope.\n\xa0\nKT: What has happened to workers who were laid off due to factory closures? \nSaly: Most of them cannot find other jobs, mainly because very few factories are recruiting and they do not have the skills to work in other sectors. To make matters worse, they also have to compete with returning migrant workers from neighbouring countries. It is a very hard time for everyone, especially for unemployed and unskilled workers. They simply stay home and rely on the assistance provided by the government.\nKT: How can these problems be solved?\nSaly: The government, especially the Ministry of Labour, needs to provide free training to prepare unskilled and laid-off workers for the sectors which are still thriving. Those include IT, video design, video editing, mechanical, agriculture and so on. For those who are from rural areas, I believe that advanced farming skills are best for them since they can go back to their home in the province to work on their family farm or in paddy fields, which will allow them to earn enough to feed themselves and their families. I am very happy to see that the ministry has begun doing this.\nI also hope that the government will work with microfinance institutions (MFIs) to lower loan interests or restructure loans. I can see that many workers owe them money, and now without jobs, they are finding it hard to pay them back.\n\xa0\nKT: How long do you think the crisis will last?\nSaly: Despite the positive news of vaccinations, ADB predicts that COVID-19’s impact on the economy will prevail until 2024. If this is true, it means the situation of our workers in the garment industry will be dire. The government needs to diversify both the economy and the labour market to prepare for this, while attracting more investors. Cambodia has to draw more foreign direct investment from more countries – such as Japan, Thailand and the US. The country cannot depend too much on Chinese investment.\nMeanwhile, I call on all the workers in Cambodia to sign up for vocational training to increase their qualifications. They need to help themselves first before anyone can help them.'

'The Royal Government will\xa0 stand by its forecast\xa0 that the economy will not\xa0 contract by more than -1.9 percent this year.\xa0 In addition, it has forecasted that\xa0 positive growth will return in 2021 with an estimated 3.5 percent.\nMEF spokesman Meas Soksensan, told Khmer Times that the government will\xa0 stand by its forecast made earlier this year.\xa0 “If there is a severe impact on the economy because of\xa0 the COVID-19 pandemic, the government will find ways to reverse it, but in the medium term there is no change as there are three months left to end the current year,” Soksensan added.\nThe Asian Development Bank (ADB) has recently revised its 2020 growth forecast, predicting Cambodia’s economy will contract by 4 percent, from its previous prediction of a 5.4 percent contraction in June because of improved agricultural performance and increased volume of non-garment exports.\nThe World Bank meanwhile\xa0 has forecasted a sharp contraction of -2 percent for the local economy this year, adding that Cambodia’s unfavourable growth outlook alongside disruptions to jobs and lower household incomes meant poverty is likely to increase.\nSoksensan said that based on the revision of forecasts by the World Bank and ADB, it showed that the Kingdom’s economic growth has seen a slight progress from their earlier prediction. He added that the prediction of these international financial institutions are almost similar to the government’s prediction,” he added.\n“Our national budget is not affected greatly, especially the revenue from\xa0 tax collections,” he said.\n“Earlier this year, we expected about 60 to 65 percent success in tax collections, but the revenue collection from taxation now is reaching between\xa0 85 and\xa0 90 percent of the projection.” Soksensan added.\nHe said that the government will look at the revenue from custom and excise entity, which will be revealed by the end of the year.\nLim Heng, vice-president of Cambodia Chamber of Commerce, told Khmer Times that the Kingdom’s economy has not been severely impacted\xa0 by the COVID-19 pandemic as the government has managed to control\xa0 the spread of the virus. Therefore, business activities, domestic tourism, trading and exports have been progressing as usual without much disruption.\n“With the recent government’s extended support measures to aid the garment and textile industry, tourism and aviation sectors until the end of the year, it will help boost economic activities and help in the economy’s recovery,” Heng added.\n“Until today, our local economy is not stagnant. Our exports, especially, agricultural commodities are also increasing. I think there was not much impact on the economy because of COVID-19,” he added. The real estate market which is also weary of a plunge has remained resilient. Sales and purchase of\xa0 properties are continuing while\xa0 new projects are being launched continuously,”\xa0 Heng added.\nAnthony Galliano, group chief executive officer of Cambodian Investment Management Group, said that the impact of the pandemic descended upon the Kingdom’s economy in February and at that time the general view was that there would be a 5 to 6 percent contraction in GDP.\nHe said that internationally the economic downturn is staggering. In 2020, India has contracted 25 percent, U.K. 20 percent, France 14 percent and the United States 9 percent.\n“It would be naive to believe the Kingdom would escape unscathed and frankly I expect we are far from returning to any degree of normalcy, given the endurance of the pandemic, which is returning even more vigorously,” Galliano said.\n“I expect the economy to weaken further in the last quarter and do not believe there will be an upswing in 2021, at least certainly not in the first half, resulting in an overall downturn for next year,” he added.\nThe draft\xa0 macro-economic policy framework and public financial policy framework 2021 stated that in 2020, Cambodia’s economy is forecasted to shrink by -1.9 percent. The negative growth caused by the spread of COVID-19 which has\xa0 pushed external\xa0 demands to\xa0 drop significantly and also negatively impacted the growth figures of Cambodia’s trading partners.'

'Many businesses have re-opened since June but sales are still down significantly, especially micro, small and medium-sized companies (MSMES), with firms in Siem Reap very badly hit, according to the World Bank’s Cambodia Business Surveys (BPS).\nThe BPS was taken to understand the economic effects of COVID-19 on companies. It was conducted in June and September and covered more than 500 firms. The survey showed marked signs of reductions in firm closures and sales but the impact is still being felt widely. It added that findings from June and September show that firms continue to face substantial hardship through a variety of channels, with a long road to recovery ahead.\nThe global COVID-19 pandemic has prompted governments around the world to take measures to reduce the spread of the virus. Lockdowns have mandated non-essential businesses to close or significantly reduce staff at work but, even in the absence of mandatory closures, revenue and businesses operations have faced severe consequences of large negative labour and consumer demand shocks, according to the survey.\nLike other countries in the region, Cambodia ordered closures in early April of a range of businesses that presented a high risk of COVID-19 transmissions, such as gyms and fitness centres, spas, cinemas, casinos, karaoke bars and entertainment clubs. With the limited local COVID-19 outbreak, many of these restrictions were lifted in July and August on the condition that additional health precautions be put in place.\n“Consistent with the return of domestic economic activity, the findings of the BPS show that firms have continued re-opening their businesses since June. The share of firms that were open has risen from a then high of 81 percent in June to 89 percent in September,” said the survey.\nIt added that in September, 8 percent of firms remained temporarily closed because of the pandemic, compared with 16 percent in June.\nThe re-opening progress has not been uniform across sectors. While more than 90 percent of businesses were open in sectors such as manufacturing, construction, utilities, wholesale and retail trade, financial activities and health in June,\xa0 businesses in other sectors were very limited in their ability to operate.\n“For example,\xa0 between 55 percent and 60 percent of firms in accommodation, food services, transportation and storage were open in June. With between 80 percent and 83 percent of firms in these sectors open in September, they have caught up considerably but are still below average. The education sector, at 64 percent, had the lowest share of being open in September.”\nAlthough the majority of businesses have opened their doors, most continue to suffer a large, negative impact on sales. The share of firms reporting a decline in sales in the past 30 days has decreased from its June level of 87 percent to a still high\xa0 71 percent in September. In June, firms reported an average decline in sales of 49 percent.\nIn September, the average change in sales was less severe, but still negative at minus 30 percent. With further reopenings, the rate of sales recovery in Cambodia is overall better than other countries in East Asia and may improve faster, provided the COVID-19 pandemic remains under control without further lockdowns.\nThaung Thyda, the founder of Thaung Enterprise, a salt supplier in Kampot, said her business has seen sales down 50 percent since the pandemic hit. “I believe we are facing the same issue as other SMEs [small and medium enterprises]. Sales slowed because some markets closed down – restaurants, hotels and gift shops,” she added.\nThyda expects sales will resume in the second quarter of 2021. She added that, as a global pandemic,the economy suffered severely, especially in developing countries such as Cambodia.\n“At our company, what we can do to overcome this is not to give up and\xa0 survive as best we can. We would love to revive our strategy again for nationwide supplies and hopefully we could receive more support both from the social fund and the government,” Thyda added.\nAccording to BPS’s September results, firms’ expectations for future sales were on average 10 percent lower, with many respondents expecting close to no change. In comparison, in June firms expected the change in sales to be 28 percent lower on average during the following six months.\n\xa0'

'The International Monetary Fund (IMF) is projecting that Cambodia will be the third-fastest growing economy in ASEAN next year and the region’s fastest growing economy in 2025.\nIn its World Economic Outlook released during the IMF’s annual meeting on Tuesday, Cambodia’s economy is forecast to shrink 2.8 percent this year — slightly more than the 1.5 percent contraction forecast for Indonesia.\nAmid the COVID-19 pandemic, deeper contractions of 8.3 percent are forecast for the Philippines, 7.1 percent for Thailand and 6.0 percent for both Malaysia and Singapore.\nMyanmar is forecast to be the fastest growing ASEAN economy this year with GDP expanding by 2.0 percent followed by Vietnam with growth of 1.6 percent.\nLaos is forecast to grow only 0.2 percent and Brunei by just 0.1 percent.\nIn 2021, Malaysia is seen posting the sharpest recovery (7.8 percent) followed by the Philippines (7.4 percent), Cambodia (6.8 percent) and Vietnam (6.7 percent).\nAmong the other ASEAN economies, slower growth is forecast for Indonesia (6.1 percent), Myanmar (5.7 percent), Singapore (5.0 percent), Laos (4.8 percent), Thailand (4.0 percent) and Brunei (3.2 percent).\nThe IMF’s mid-term projections for 2025 show Cambodia outpacing its peers with growth forecast at 6.9 percent, making the country the region’s fastest growing economy.\nSlower growth is forecast for Vietnam (6.6 percent), Myanmar and the Philippines (6.5 percent), Laos (6.1 percent), Indonesia (5.1 percent), Malaysia, (5.0 percent), Thailand (3.7 percent), Singapore (2.5 percent) and Brunei (1.8 percent).\nIn her forward to the outlook, IMF Economic Counsellor and Director of Research Gita Gopinath said the latest forecasts for 2020 were “somewhat less severe though still deep” compared with IMF forecasts in June.\n“The revision is driven by second quarter GDP outturns in large advanced economies, which were not as negative as we had projected,” she said.\nGopinath also highlighted “stronger than expected” growth in China — which is forecast to grow 1.9 percent this year — and signs of a more rapid recovery in the third quarter.\n“Outturns would have been much weaker if it weren’t for sizable, swift, and unprecedented fiscal, monetary, and regulatory responses that maintained disposable income for households, protected cash flow for firms, and supported credit provision,” she said.\n“Collectively these actions have so far prevented a recurrence of the financial catastrophe of 2008-09.”\nGopinath said near-term support policies “should be designed with a view toward placing economies on paths of stronger, equitable, and sustainable growth.”\nIn the longer term, she highlighted the need for policymakers to “simultaneously aim to mitigate climate change and bolster the recovery from the COVID-19 crisis.\n“This can be achieved through a comprehensive package that includes a sizable green public infrastructure push, a gradual rise in carbon prices, and compensation for lower income households to make the transition fair.”\nThe IMF devotes an entire chapter of the World Economic Outlook to climate change.\nIt finds that investing in green infrastructure could raise global activity “with modest output costs over the medium term as economies transition away from fossil fuels toward cleaner technologies.\n“Relative to unchanged policies, such a package would significantly boost incomes in the second half of the century by avoiding damages and catastrophic risks from climate change.\n“Moreover, health outcomes would begin to improve immediately in many countries thanks to reduced local air pollution,” the outlook says. Sao Da – AKP'

'AFP – Eleanore Fernandez lost her job as an executive assistant when the Coronavirus pandemic struck in March, and things have only grown worse in the months since.\nHer husband, a professional musician, was also put out of work and she is just weeks away from losing the US government unemployment benefits that have helped sustain Fernandez and her teenage daughter.\n“I’ve never been in a situation where it’s like, this hairy,” Fernandez said, noting she is “taking more out of my savings account.”\n“I’m going to run out soon if nothing happens,” she said.\nThe Coronavirus pandemic caused the US economy to shed more than 20 million jobs and although some people have been rehired, data shows the jobless are remaining out of work for longer as the virus again surges nationwide.\nWith the extra unemployment benefits approved by Congress set to lapse at the end of the year, economists warn the US labour face is facing long-term damage ahead of Joe Biden’s inauguration as president in January.\n“We’ve been concerned about longer-run damage to the productive capacity of the economy,” Federal Reserve Chair Jerome Powell said last month.\n“Workers who are out of work for long periods of time, they may lose their contact with the labour market. They may lose their skills.”\nLabor Department data for October showed nearly 3.6 million people in the United States have been unemployed for at least six months.\nThat is equivalent to about a third of the total unemployed population, and is a sign a significant share of people who lost their jobs in the early weeks of the pandemic, in March and April, have not been able to find work.\nThe figure is 1.2 million higher than in September, making it “the highest month-over-month increase in history,” Michele Evermore, senior policy analyst at the National Employment Law Project, said.\nFernandez has spent fruitless months applying for work and is left to wonder what will happen when extended unemployment payments authorised by Congress in March run out on Dec 26.\n“I’m going to have to take anything or deliver groceries, too, or something,” she said.\nThat dilemma is exactly what the central bank chief warned of and what analysts say will make the pandemic damage linger even after the virus is brought under control.\nWhen “people lose attachment to the workforce, particularly once they fall off of unemployment insurance, they stop looking for work, they start figuring out something else, you know, turning to the informal economy”, Evermore said.\nThe government is scheduled to release the November employment report on Friday, and Evermore predicted that, with the economy far from fully healed, the ranks of the long-term jobless will swell further.\nBefore the crisis, the US had a historically low unemployment rate of 3.5 percent, but most economists believe returning to that level is years away.\nAnd the pandemic could change the labour market in other lasting ways, as more jobs shift away from service industries towards the tech sector, requiring costly and time-consuming re-training to prepare unemployed workers for these new opportunities.\nAs with most economic trends in the US, the pain is not being felt equally.\nAfrican Americans, who have the highest unemployment rate among all racial groups, suffer from what Evermore called “first fired, last hired syndrome” because they have the weakest job prospects and tend to be laid off first.\nSome communities had never fully recovered from the lingering pain of the 2008-2010 global financial crisis, and the pandemic will compound that damage as it ripples out into the wider economy.\n“It’s not just individuals who are unemployed and get hurt, but it’s their entire community because they don’t have that money to spend it at the local stores,” she said.\nNadra Enzi, who has been unemployed since April, is already seeing this happen where he lives in New Orleans.'

'Landed property (Borey) projects are still in strong demand during the COVID-19 pandemic but real estate industry insiders say one must be careful with an oversupply situation while mortgage applications to banks have reportedly dropped significantly during the first half of the year.\nThe number of new launches of\xa0 landed property (Borey) in the third quarter of the year was 12 borey projects over the period of Q2 to Q3 2020 within seven districts in the Capital, namely Khan Sen Sok, Chroy Changva, Mean Chey, Prek Pnov, Kambol, Pou Senchey, and Dangkao, according to a CBRE report.\nThe\xa0 report also stated that though Cambodia is hit by the pandemic,\xa0 prices of landed property remains promising.\nIt detailed that the price of a flat is ranging from $107,000 per unit, an increase of 3.4 percent in Q3, 2020,\xa0 Linkhouses range\xa0 from $143,000 per unit and showing\xa0 a 12.5 percent increase.\nShophouses are\xa0 up to 5.4 percent higher and\xa0 range from $238,000 per unit, while a Twin Villa is up by\xa0 9.2 percent, from around $297,000 per unit.\nPrime Minister Hun Sen yesterday also mentioned that during the pandemic, construction is still ongoing, especially in the landed property (Borey) segment and the demand for houses is still there, and it creates thousands of jobs for\xa0 Cambodians.\nGrace Rachny, executive director of Century 21 Cambodia, told Khmer Times that the average price and demand of\xa0 landed property (Borey) is still good; while, the developers are targeting the local buyers.\nShe said developers are developing and launching their Borey projects phase by phase. Therefore, there is no real issue on an oversupply.\n“The secondary market for Borey is still good as buyers can buy more since they are at an affordable price compared with last year as well as since there is good payments terms” she added.\n“The strategy for developers in launching phase by phase with good payment terms, works well” Rachny added.\nRachny however said if the price of the landed property is around $200,000 to $300,000 per unit, there will be issues as the buyers are depending on their monthly salary, so they can be affected during the Pandemic if there are job losses, but the mid range landed property still fetches good values because the buyers are purchasing the house for living and not as an investment.\nFrom 2015 to 2030, the demand for new homes is estimated to be 1.5 million. The demand in Phnom Penh alone could amount to some 800,000 more houses. Based on this figure, Cambodia would need to build 50,000 units per year to meet the demand because of rapid urbanisation.\nBy the end of 2019, Cambodia supplied more than\xa0 38,488 new general houses and 8,331\xa0 affordable homes across the country, according to a report from Ministry of Land Management, Urban Planning and Construction.\nIf we take a look at the price of landed property and new project launches, it shows that the\xa0 sector is performing better during the pandemic. However, if we take a look at the mortgage report from the Credit Bureau of Cambodia (CBC), the mortgage applications has dropped dramatically in the first half of 2020.\nIn the first half of 2020 across the country, mortgage applications fell by 51 percent, according to the Credit Bureau of Cambodia (CBC). CBC is the leading provider of credit information, analytical solutions and credit reporting services to banks, microfinance institutions, lending companies, credit operators, and consumers in Cambodia. CBC added that consumer loan balance by type as of June 2020, was $8.73 billion. Of these, loan balance accounted for\xa0 50.47 percent on mortgages, 48.96 percent on personal finance and 0.57 percent on credit cards.\nJames Hodge, a senior director at CBRE Cambodia, told Khmer Times that there is always a lag between buyers demand and developers expectations, so developers\xa0 tend to increase their prices when they launch their project compared to the competition because they often want to provide something unique or different.\nHe said that if their project has been active for six months and they had a very good sales period in the first three months and then it slowed down it doesn’t matter as it pushes the price up.\nHodge added that with regards\xa0 to mortgage rates, it doesn’t always fully indicate exactly what is happening in the market, what the government called the grey banking sector (unregulated banking sector) where the developers are providing the finance.\nThis is now coming under government regulation which is a really good thing so that the government got the oversight of what those developers are doing. It may just mean that the number of people moving away from bank mortgages across the market including landed property is increasing.\n“So when we are talking about landed property is comes down to completion more than an oversupply so what you will see is developers working harder to get customers in. That said, an oversupply can occur in the secondary market when a buyer is trying to resell their landed property,” said Hodge.\nAccording to the CBRE report, the roadmap to recovery on the landed property is for the developers to do more daring promotions, speeding up on construction activity to meet the handover requirement, focusing on the affordability of the projects, and focus on the low-to-mid-rise development to be introduced in\xa0 future Borey projects.'

'Money sent back by Cambodian migrant workers in 2020 is projected to decline to $1.4 billion because of COVID-19, according to a World Bank report.\nThe report, called “Migration and Development Brief Phase II”, released on Thursday, shows\xa0 formal remittances to East Asia and the Pacific region are projected to fall by 10.5 percent in 2020 to $131 billion.\nMoney sent to China is estimated to be $59.5 billion followed by the Philippines and Vietnam at $33.3 billion and $15.7 billion respectively. Indonesia is estimated to be $9.8 billion, Thailand ($6.1 billion), Myanmar ($2.2 billion) and Cambodia ($1.4 billion), according to the report.\nThe projected declines in remittances would be the steepest in recent history – steeper than the 5 percent reduction recorded during the 2009 global recession.\n“The foremost factors driving the declines are weak economic growth and uncertainties around jobs in migrant‐hosting countries, a weak oil price and, in many remittance‐source countries, an unfavourable exchange rate against the US dollar,” the report said.\nThe lockdowns and travel bans left many migrant workers stranded in their host countries, unable to travel back. More recently, however, return migration has been reported in all parts of the world.\nAccording to the report, about 120,000 Cambodian migrant workers are said to have returned from Thailand. This is more than 10 percent of all Cambodian workers in that country. It said there are more than a million Cambodian workers in Thailand who are mostly in low‐skilled occupations. Many of them are undocumented.\nSeveral countries with Cambodian migrant workers in the region are anxious to resume overseas placements of their workers, the report noted.\nLast year, 1.2 million Cambodian workers employed in Thailand, South Korea, Japan, Singapore, Hong Kong, Malaysia and Saudi Arabia sent home some $2.8 billion in remittances, according to figures from the Ministry of Labour and Vocational Training.\nNgeth Chou, a senior consultant for Emerging Markets Consulting, said earlier this year that, according to research before COVID-19 emerged, Cambodian migrant workers in Thailand sent on average about $300 a month home. With more than 120,000 returnees, the country could have lost out on $36 million a month.\nMar Amara, ACLEDA’s Bank’s executive vice-president and chief financial officer, said COVID-19 has basically affected transactions in both remittance and investment capital flows.\n“Money transactions have been affected in general because tourism and investment capital have been stalled,” she said.\nThe World Bank said the gap between remittance and foreign direct investment (FDI) flows are expected to widen further in 2020 because FDI flows have declined more sharply than those of remittances.\nAccording to six months of data this year, money sent back home by workers from South Korea alone through ACLEDA was $12.54 million, a decline of 12.34 percent from $14.31 million in 2019.\nHong Vannak, a business researcher at the Royal Academy of Cambodia, said the government has put many measures in place to support small and medium enterprises to maintain\xa0 employment while encouraging returned migrant workers to join the agriculture sector.\n“The country’s construction sector also helps to absorb the workforce during the pandemic,” he said, adding COVID-19 “has reduced the money sent back home while some [who stayed] receive less pay so they are not be able to send back as much as before”.'

'NEW YORK, (Xinhua)\xa0 – Wall Street’s major averages climbed modestly in the week as investors focused on news about U.S. President Donald Trump’s positive test for COVID-19 as well as updates of a fresh round of U.S. fiscal stimulus.\nFor the week ending Friday, October 2,\xa0 the Dow added 1.9 percent, while the S&P 500 and the Nasdaq both gained 1.5 percent.\nThe S&P U.S. Listed China 50 index, which is designed to track the performance of the 50 largest Chinese companies listed on U.S. exchanges by total market cap, logged a weekly rise of 1.9 percent.\nMarket fluctuations remained high on Wall Street this week, and in particular, on Friday, as U.S. stocks finished lower in volatile trading amid concerns over Trump’s health issue.\nTrump said early Friday morning that he and his wife Melania had tested positive for COVID-19, after a close aide contracted the virus.\nThe news came as the pandemic continued to wreak havoc across the country.\nThe president’s positive test fueled market concerns as the news added to uncertainty going into the election, experts noted.\n“Markets are likely to focus on the effect of the news on the election outcome and public health policy,” analysts at UBS said in a note on October 2.\nInvestors were also worried that the diagnosis would overshadow negotiations in U.S. Congress for another round of fiscal stimulus to combat the economic fallout of the pandemic.\nThe Democrats-controlled House of Representatives last Thursday night passed a $2.2trillion- COVID-19 relief bill, despite that Democrats and the Trump administration remain far apart on an agreement.\nIt is not clear whether the two parties could bridge their differences and reach an agreement on the relief package before the presidential election on Nov. 3.\nLooking ahead, experts noted that market volatility is likely to remain high as election uncertainty and concerns about the outlook for the U.S. economic recovery would continue to rattle investors.\n“2020 is no stranger to volatility and the fears and unknowns that come with it. The upcoming election only adds one more unknown to the pile,” Mitch Zacks, CEO at Zacks Investment Management, said in a note on Saturday.\nOn the data front, U.S. employers added 661,000 jobs in September, pushing the unemployment rate down by 0.5 percentage point to 7.9 percent, the Bureau of Labor Statistics reported last Friday. Economists surveyed by Dow Jones expected a jobs gain of 800,000.\nThis compared to an upwardly revised 1.49 million jobs gains in August, when unemployment rate fell by 1.8 percentage points to 8.4 percent, indicating a slowing recovery in the labor market ravaged by the COVID-19 pandemic.\nU.S. initial jobless claims, a rough way to measure layoffs, stood at 837,000 in the week ending Sept. 26, following an upwardly revised 873,000 in the prior week, the Department of Labor reported on Thursday.\nU.S. manufacturing PMI (Purchasing Managers’ Index) registered 55.4 percent in September, down 0.6 percentage point from the August reading of 56 percent, said the Institute for Supply Management.\nThe U.S. economy contracted at an annual rate of 31.4 percent in the second quarter amid mounting COVID-19 fallout, 0.3 percentage point higher than the previous estimate in late August, the U.S. Commerce Department said in its third and final estimate released Wednesday.'

'The Health Ministry has still not come up with a plan of action to pre-order COVID-19 vaccines although countries around the world have already done so.\nThis is despite the fact that Prime Minister Hun Sen last Monday ordered officials from the ministries of Health and Finance to urgently meet and discuss the sourcing and funding of a vaccine.\nThe following day, officials from both ministries met on the matter and after three days have still not announced a decision.\nHealth Ministry spokeswoman Or Vandine said yesterday that the officials are still working to monitor the effectiveness of vaccines before ordering any.\n“The team is working on this, we are not silent, we are working,” she said. “We are\xa0also working with WHO under the Covax initiative to ensure that Cambodia also has access to the COVID-19 vaccine when it is safe and approved by the World Health Organization.”\nBritain has already begun vaccinating some of its citizens while the United States has deployed truckloads of vaccines across the country for the purpose.\nOn Saturday, the Ambassador of the People’s Republic of China to Cambodia, Wang Wentian, posted in his Facebook that the Chinese Embassy is now in contact with the Cambodian government, for possible use of China-made COVID-19 vaccines in the Kingdom.\n“While there are several options, the Chinese vaccine is outstanding because of its safety (using the traditional method of inactivation), effectiveness (86 percent when 75 percent is average for similar vaccines) and convenience (can be stored and transported at temperature 2-8 ℃),” he added.\nYesterday, Wang could not be reached for comment about how many doses of COVID-19 vaccine that China will provide to Cambodia.\nVandine said that she does not yet know when Cambodia will receive the COVID-19 vaccine from China and for how many doses.\n“I do not have this information,” she said.\nRecently a Chinese Embassy official outlined to local media the Chinese government’s position: “Once a vaccine developed by China is approved for distribution in the market, it will always be a priority for Cambodia and this position will not change.”\nLast week, Mr Hun Sen announced a plan to purchase 20 million doses of vaccine for 10 million Cambodians (two doses per person) to be inoculated for free. For the first step, he plans to buy one million doses of vaccine for 500,000 Cambodians.\n\xa0\nAs of Friday, the government has raised more than $45 million from donors for the purpose.\nOn another matter, Vandine said that unlike a Western country, Cambodia will not reduce the 14-day quarantine period for inbound travellers.\nThe US Centers for Disease Control and Prevention is reported to have said on Wednesday that it is shortening the recommended quarantine period from 14 days after a person has been exposed to the coronavirus, offering two alternatives.\nThe first alternative is to end quarantine after 10 days if no symptoms are reported, Dr Henry Walke, the CDC’s COVID-19 incident manager, reportedly said. The second option is to end quarantine after seven days if an individual tests negative and also reports no symptoms.\nVandine said Cambodia must maintain the 14-day quarantine requirement because the ministry has found people testing positive on the 13th day of their quarantine.\n“If we reduce the number of days of quarantine and people become infected on the 13th day, then when the patients walk out they will spread the virus throughout the community,” she said.\n“Even the World Health Organization has not changed its 14-day quarantine policy,” she said. “France used to have quarantine for a week, but then the disease spread again.”\nIn related news, the Health Ministry announced yesterday that it has found two new imported cases in the Kingdom, raising the tally to 359.\nIn a press statement, it said the cases are a 47-year-old Jordanian man, residing in Phnom Penh, who flew in from Jordan via South Korea on Thursday. He tested positive for the virus on Saturday.\nThe patient is currently being treated at the National Center for Tuberculosis and Leprosy Control which is now being used to treat COVID-19 patients.\nThe 76 passengers who flew in with him tested negative and were placed in a 14-day quarantine at two hotels in Phnom Penh.\nThe other case was a 32-year-old Cambodian man, residing in Phnom Penh, who flew in from Mali via South Korea on Friday. He tested positive for COVID-19. He is also being treated at the National Center for Tuberculosis and Leprosy Control.\nSixty-two passengers with him tested negative for COVID-19 and are being quarantined for 14 days at two hotels in Phnom Penh.\nMeanwhile a total of 8,814 people have had samples taken during a third round of tests in relation to the “November 28 community incident” on Saturday. Of them, 3,002 tested negative for COVID-19 and the remaining samples are still being analysed.\nTo date, a total of 359 cases (84 females and 275 males) have been detected, of which 307 people have recovered and 52 people are currently hospitalised. The cases include 239 Cambodians, 45 French, 18 Chinese, 13 Malaysians, 12 Americans, nine Indonesians, six Britons, three Vietnamese, three Canadians, three Indians, two Hungarians, two Pakistanis, one Belgian, one Kazakhstani, one Pole and one Jordanian.\nOf these, 40 are from the “November 28 community incident”.'

'COVID-19 has affected the Kingdom’s automotive industry severely, with trade dropping nearly 40 percent compared with the previous year.\nAccording to the latest import and export statistics for the first nine months of this year, the volume of automobiles and motorcycles\xa0 exported dropped by 34.1 percent and 39.5 percent respectively compared with year-to-date figures.\nMajor domestic auto dealers attribute this drop in Cambodian supply and demand in the sector to the pandemic.\nThe RMA Group (RMA), which is listed on the Cambodia Stock Exchange, stated in its latest financial report that because of the pandemic several large-scale private and public investment projects in Cambodia have been postponed or cancelled and. this coupled with a weakening of consumer confidence, the tourism and hotel industries having suffered heavy losses and the nation’s banks being more cautious in lending has contributed to the decreased demand for automobiles.\nRMA, which primarily represents the Ford Motor Co of the United States, said that movement control measures implemented by various countries have also affected the [regional] supply chain. They cited the Ford assembly plant in Thailand having had their deliveries interrupted by supply chain problems for a period earlier this year.\nKevin Whitcraft, chairman of the group, pointed out in its latest financial report that while the pandemic has been well controlled in the Kingdom, its economic effects are indeed still being strongly felt across the economy.\n“Some government departments have cut their spending by half compared with last year and many investment projects have had to be postponed to the first or second quarter of next year,” noted Whitcraft.\nHe also said the the weakening in consumer confidence and tightening of lending conditions by banks had negatively affected sales of automobiles, heavy machinery and agricultural machinery.\nRMA Group’s revenue for the first three quarters of this year was approximately $230 million, an increase of 0.3 percent over the same period last year. Gross profits reached approximately $33.6 million, a year-on-year decrease of 4.4 percent.\nIn order to stimulate sales in the face of fierce competition, the company decided to entice customers with additional discounts which affected the company’s profit margin.\nCars and motorcycles are Cambodia’s leading, durable imports. However, they were not the only categories to experience trade volume decreases.\nImports of consumer appliances (including mobile phones and televisions) dropped by 45.9 percent from the same period last year and food imports fell by 16.8 percent. Gasoline and diesel imports increased by just 0.3 percent and 2.7 percent respectively.\nThe World Bank has stated that alongside Cambodia’s imports having dropped significantly this year, the country’s exports also dropped sharply. This further expanded the Kingdom’s trade deficit.\n\xa0'